Mastering Business Efficiency

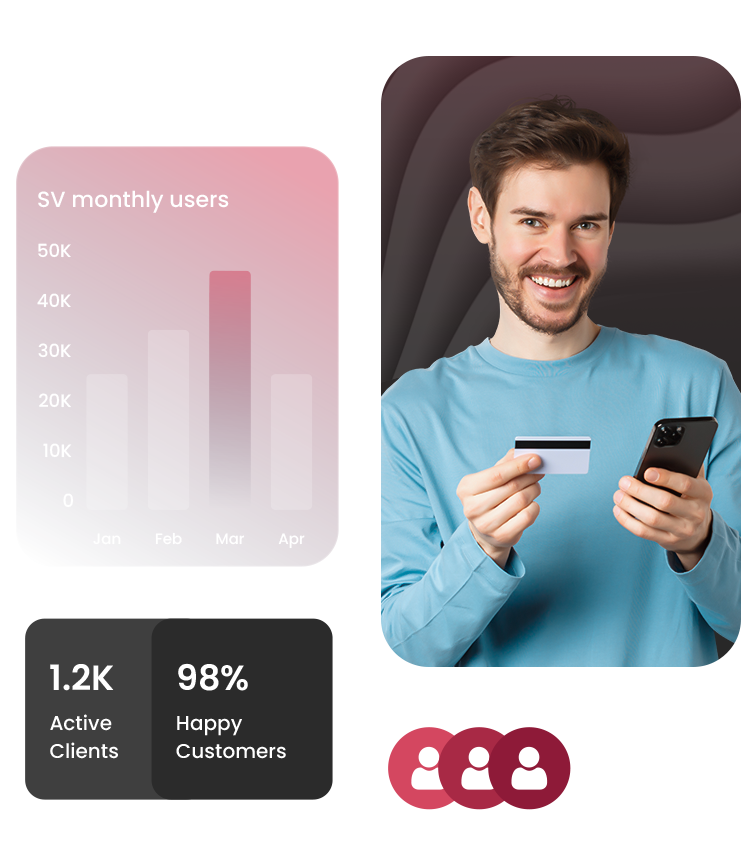

At (website name), we recognize the pivotal role vendor payments play in the success of your company. Understanding the crucial function payments serve, we've meticulously crafted a cutting-edge vendor payment solution. Our state-of-the-art system excels in three key areas: unparalleled security, unmatched ease of use, and unparalleled efficiency.

With our streamlined payment experience, manual hassles become a thing of the past, allowing your business to focus on what truly matters—growth and prosperity. Trust us to perfect your payment process, ensuring your business operates seamlessly, efficiently, and securely.

Transforming Vendors

into Valued Partners

Vendor Relationship Enhancement

Building Trust Through Timely, Secure, and Efficient Payment Solutions.

Customized Financial Solutions

Tailored Vendor Payment Plans for Businesses of Every Size and Scale.

Elevating Vendor Bonds With Spark Lasting Alliances

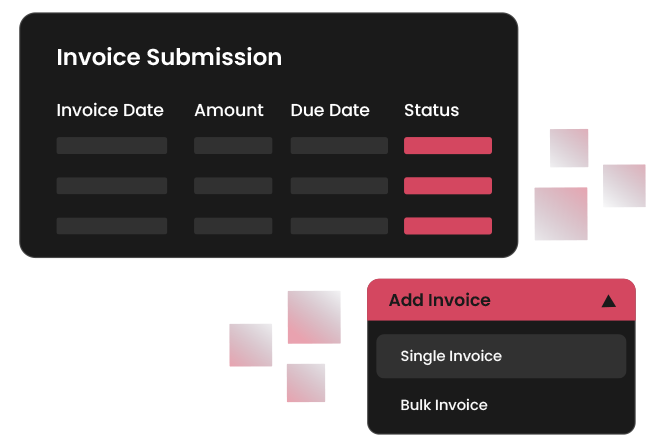

Invoice Submission

Vendor payments commence when a vendor submits an invoice outlining the products or services provided. The accounts payable department meticulously scrutinizes the invoice for accuracy, cross-referencing it with purchase orders and delivery receipts to detect any discrepancies. This step also involves ensuring the invoice adheres to pre-established terms and pricing agreements to maintain financial integrity.

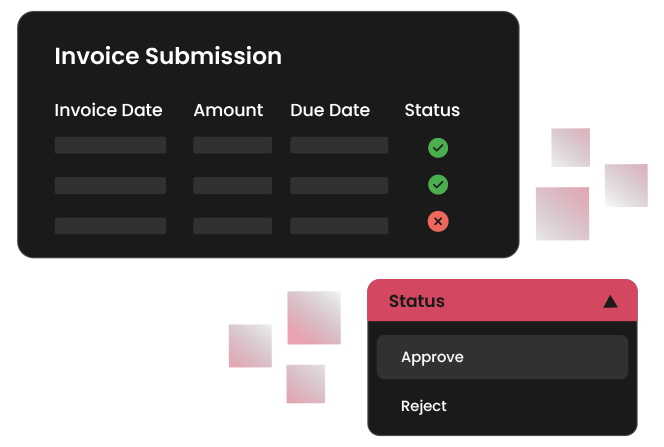

Approval Workflow

Once the invoice is verified, it enters an approval workflow, where it is routed to relevant individuals or departments for authorization. This vital step guarantees that the goods or services were received as specified and that the payment is in line with the company's procurement and financial policies. On account of taking it into filed transactions would be helpful in the future.

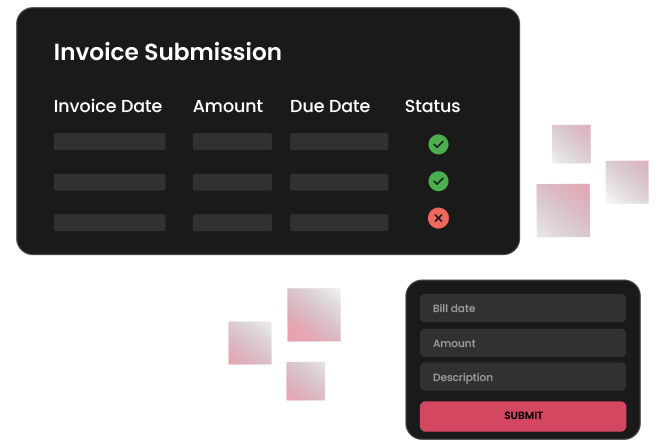

Payment Processing

Upon receiving the necessary approvals, the invoice is prepared for payment. The finance department takes the lead in this phase, initiating the payment process. Payment methods can vary, including checks, electronic transfers, or credit card payments, depending on the agreed-upon terms. Subsequently, funds are disbursed to the vendor as scheduled. Which can make the business enormous growth.

Reconciliation of records

Accurate financial records are maintained by documenting payment details within the company's accounting system. This includes archiving the approved invoices and relevant payment documentation. Additionally, regular reconciliations are carried out to ensure that payments align precisely with the authorized invoices, helping to identify and rectify any discrepancies or errors within the payment process.

Dynamic Business Approach

By Igniting Change

Breaking boundaries to building financial brilliance and shaping future forward business landscape with bold idealogy

Efficiency and Time Savings

Automate vendor payouts, saving time and effort, ensuring prompt payments, and reducing manual workload for streamlined operations.

Enhanced Vendor Relationships

Build trust with timely payments, fostering collaboration and a positive reputation within the business ecosystem.

Accurate Financial Records

Automate payouts for precise accounting, error reduction, and accurate records, simplifying audits, tax filings, and decision-making.

Cost-Effectiveness

Reduce operational costs through automation, eliminating expenses like check printing and postage, leading to significant savings.

Data Security and Compliance

Implement secure payment systems meeting regulatory standards, ensuring data protection, compliance, and vendor confidentiality for robust security.