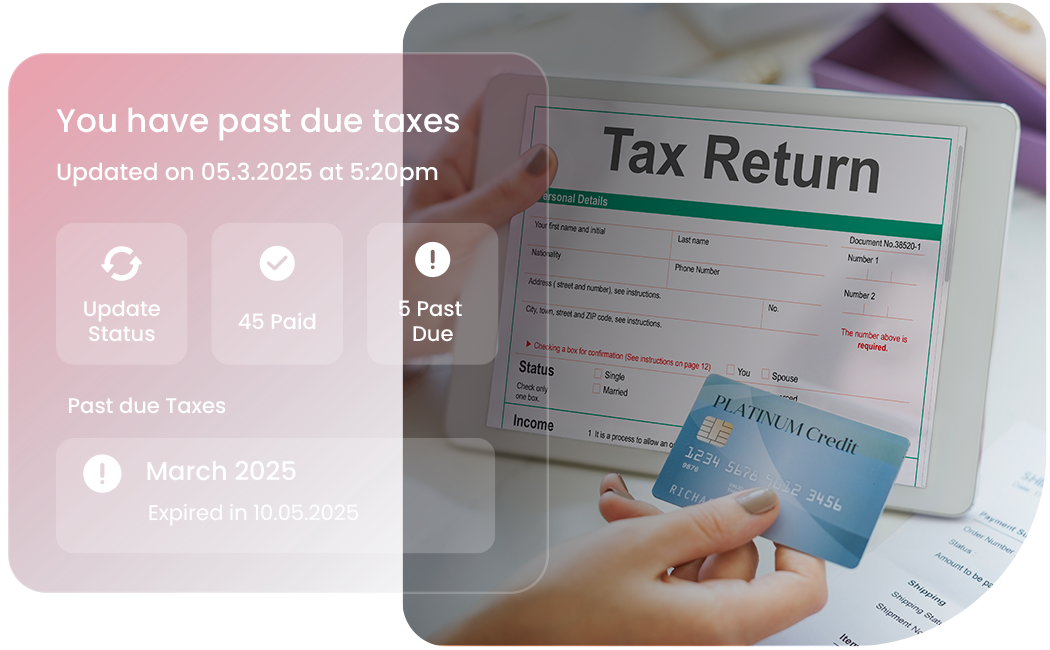

Easing Taxation Worries One Click at a Time

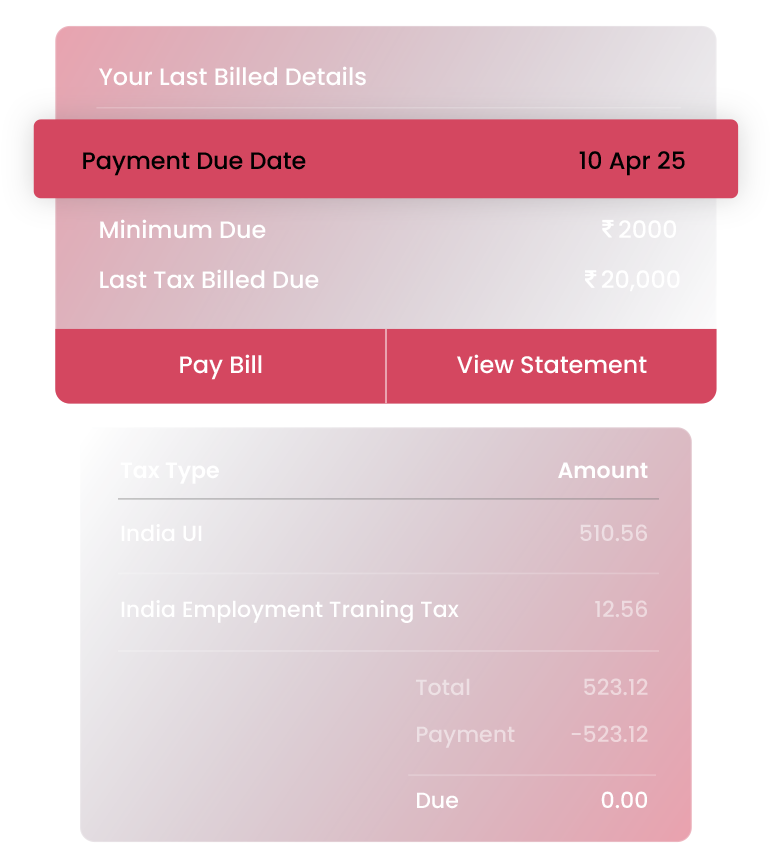

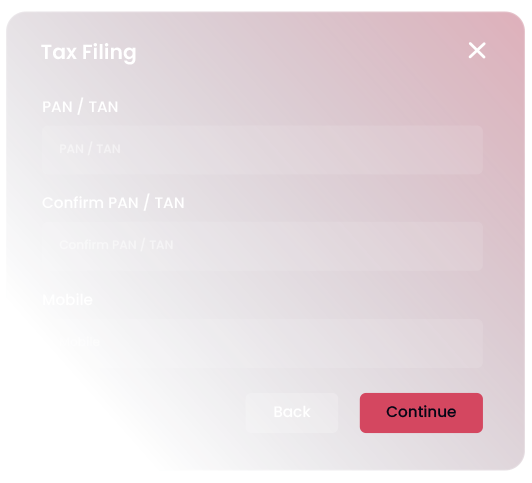

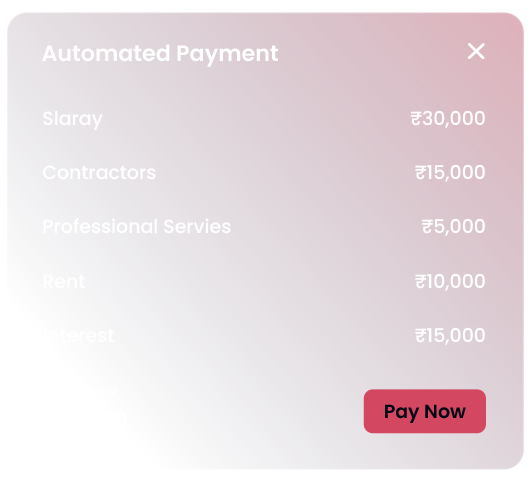

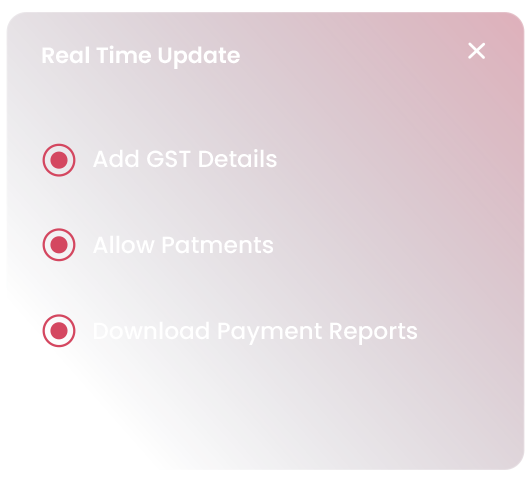

Our seamlessly integrated GSTIN solution brings you the advantages of simplified tax filing, error reduction, and enhanced operational efficiency. Bid farewell to the complexities of manual tax calculations and embrace the precision and speed of automated GSTIN processing. Discover the potential of GSTIN and revolutionize your tax compliance process.